Rising inflation predictions: what you need to know

Anúncios

Rising inflation reduces purchasing power, making money less valuable over time, and requires individuals to adapt financial strategies such as investing in assets and adjusting budgets to maintain economic stability.

Rising inflation predictions can be unsettling, making us question our financial future. Have you thought about how these predictions might impact your daily spending and savings? Let’s dive into the key factors affecting inflation and what it means for you.

What factors drive inflation predictions?

Many factors contribute to inflation predictions. Understanding these factors helps us make informed decisions about our finances. Let’s explore the key drivers of inflation.

Anúncios

Economic Growth

When the economy grows, demand for goods and services often increases. This rise in demand can lead to higher prices, pushing inflation rates up. Economists closely monitor indicators like GDP growth to gauge future inflation levels.

Supply Chain Disruptions

Disruptions in the supply chain can significantly impact prices. For instance, natural disasters or global events can limit the availability of goods. This scarcity can cause prices to rise, as seen during the pandemic.

- Disruptions affect production rates.

- Transportation issues can delay deliveries.

- Consumer demand remains high.

Moreover, government policies also play a role. When governments inject money into the economy, it can fuel spending, leading to increased inflation. However, these policies are often necessary to stimulate growth during economic downturns.

Anúncios

Commodity Prices

Changes in the prices of essential commodities, like oil and food, can influence overall inflation. For example, an increase in oil prices can raise transportation costs, which affects the price of many products. Consequently, consumers might face higher expenses at the grocery store and gas station.

Monitoring Expectations

Inflation expectations shape consumer behavior, influencing spending and saving habits. If people expect prices to rise, they may spend more now rather than wait. This behavior can create a self-fulfilling prophecy, escalating inflation further.

In summary, recognizing the **drivers of inflation predictions** can prepare us for future economic changes. By staying informed, we can adapt our financial strategies to navigate inflation more effectively.

How rising inflation affects purchasing power

Rising inflation has a significant impact on purchasing power. When inflation increases, the value of money decreases, which affects what consumers can buy. This means that the same amount of money buys fewer goods and services than before.

Understanding Inflation’s Impact

As prices rise, consumers often notice that their daily expenses increase. Common items like groceries and gas become more expensive, putting pressure on household budgets. It’s essential to grasp how these changes can alter financial behavior and spending patterns.

Effects on Household Spending

Many households may need to adjust their spending habits. For instance, families might prioritize essential needs over luxury items. They may also seek out sales or discounts more actively. Here are a few changes individuals might make:

- Cutting back on dining out.

- Choosing generic brands instead of name brands.

- Reducing discretionary spending on entertainment.

Furthermore, as inflation persists, wages may not keep up with rising costs. This can lead to a decline in the standard of living as families find it harder to maintain their previous lifestyle.

Long-term Effects on Savings and Investments

When inflation rises, the real value of savings decreases. Money saved today will buy less in the future if it earns a lower interest rate than the inflation rate. This can motivate individuals to invest in assets that typically outpace inflation, such as stocks or real estate. However, these investments also carry risks, and not every consumer has the knowledge or resources to navigate them effectively.

In essence, understanding how rising inflation affects purchasing power is vital for making informed financial decisions. By being aware of these impacts, consumers can better manage their finances and adapt to changing economic conditions.

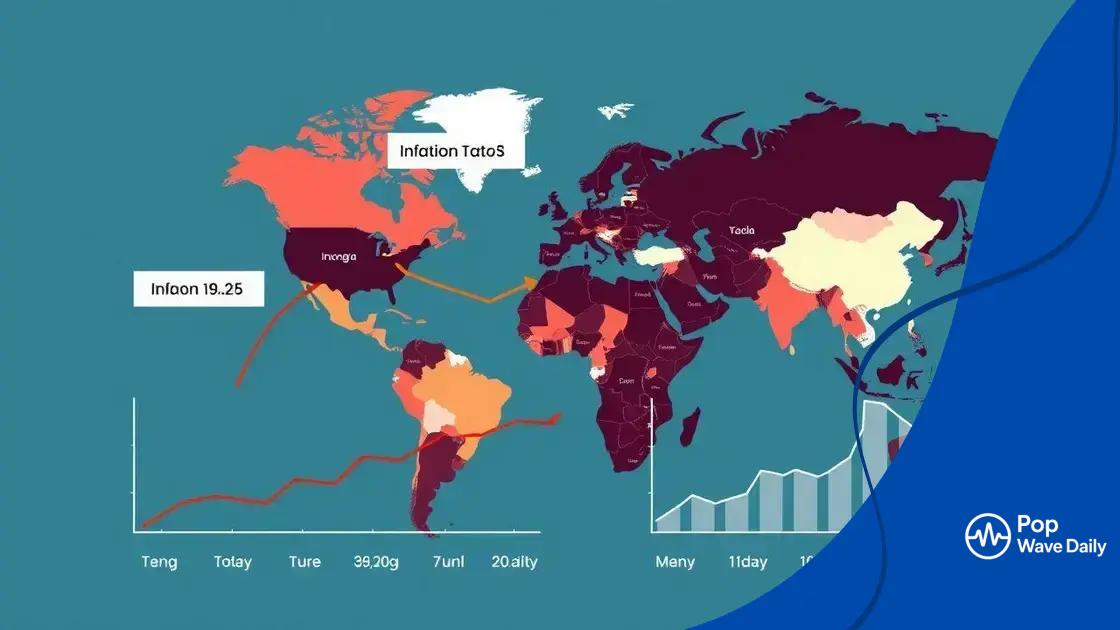

Comparing inflation trends across countries

Comparing inflation trends across countries reveals significant insights into global economies. Each nation experiences inflation differently due to various factors such as economic policies, supply chain dynamics, and consumer behavior.

Different Inflation Rates Worldwide

Inflation rates can vary widely from one country to another. For example, while some countries maintain stable inflation around 2%, others may face soaring rates exceeding 10%. Understanding these differences is essential for investors and policymakers.

Key Influencing Factors

Several factors influence inflation rates across different nations. These include:

- Currency strength affects import prices.

- Monetary policies impact money supply.

- Government spending and taxation influence overall demand.

Moreover, external factors such as global economic conditions can also ripple through individual countries. For instance, if a leading economy experiences inflation, it may impact trade partners.

Case Studies of Inflation Trends

To highlight different approaches, let’s examine a few countries. In Japan, inflation has remained low due to strict monetary policies aimed at combating deflation. In contrast, countries like Venezuela have struggled with hyperinflation, leading to severe economic consequences.

When comparing inflation trends, it’s crucial to analyze these real-world examples. They showcase how countries respond to economic challenges and how effective their measures are in controlling inflation.

In addition, tracking inflation trends over time can provide valuable forecasts. By measuring historical data, economists can predict future inflation patterns, helping governments and residents prepare accordingly.

Strategies to protect your finances from inflation

Protecting your finances from inflation is crucial for maintaining your purchasing power. As prices rise, it’s essential to adapt your financial strategies to safeguard your budget and savings. There are several effective methods to consider.

Investing in Assets

One of the most common strategies is investing in assets that typically outpace inflation. Real estate is a popular choice since property values tend to rise over time. Similarly, stocks often provide growth that can help keep up with inflation. Here are some investment options to consider:

- Real estate properties

- Stock market investments

- Commodities like gold

By diversifying your investments, you can reduce risk while capitalizing on potential growth. Keeping a mix of different asset types can provide a buffer against inflation.

Adjusting Your Budget

Another effective strategy is to regularly review and adjust your budget. This means tracking your expenses carefully to identify areas where you can cut back. Consider prioritizing essential needs over discretionary spending. By making these adjustments, you can free up more money for savings or investment.

Also, consider the impact of inflation on your fixed expenses. For example, if rent or mortgage payments are taking up a large portion of your budget, it might be time to explore more affordable housing options.

Emergency Fund

Establishing a solid emergency fund is also vital. This fund can help you cover unexpected expenses without derailing your long-term financial goals. Aim to save at least three to six months’ worth of living expenses. This can provide you with more flexibility during inflationary periods.

Continuously Educate Yourself

Finally, staying informed about economic trends and inflation rates is essential. This knowledge enables you to make timely decisions regarding your investments and spending. Regularly follow financial news and updates to understand how inflation impacts your finances.

By implementing these strategies, you can better protect your finances from the effects of rising inflation. It’s about being proactive and making informed choices to secure your financial future.

Future outlook: inflation and economic stability

The future outlook for inflation and economic stability is a topic of great interest. As we move forward, several key factors will shape how these elements interact and evolve within the global economy.

Current Economic Indicators

Economic indicators provide vital information about the health of an economy. Monitoring metrics such as inflation rates, unemployment figures, and consumer spending can help forecast future trends. For example, consistent wage growth can signal greater consumer spending, which could influence inflation positively.

Government Policies

Government policies also play a crucial role in shaping the future of inflation and economic stability. Central banks, like the Federal Reserve, implement monetary policies to control inflation. Decisions regarding interest rates can significantly impact borrowing costs and consumer spending. Here are some policies that might be enacted:

- Raising interest rates to curb excess demand.

- Implementing fiscal policies to stimulate growth.

- Adjusting tax rates to either encourage or reduce spending.

These actions can create ripple effects throughout the economy, influencing everything from individual budgets to global trade.

Global Influences

The global economic environment also impacts inflation and stability. Factors such as trade relations, geopolitical tensions, and pandemics can disrupt supply chains or influence commodity prices. Consequently, countries must remain adaptable to respond to these changing dynamics.

For example, if a major trading partner experiences supply chain issues, it could lead to increased costs for imported goods. Such changes can push overall inflation rates higher, impacting consumer finances.

Predictions and Adjustments

Experts often make predictions based on historical data and current trends. Understanding these predictions allows individuals and businesses to prepare accordingly. However, it’s essential to remain flexible, as economic conditions can shift unexpectedly.

In conclusion, the outlook for inflation and economic stability is influenced by a complex interplay of factors. By staying informed about economic indicators, government policies, and global influences, individuals can make more educated financial decisions that withstand future uncertainties.

FAQ – Frequently Asked Questions about Inflation and Economic Stability

What is inflation and why does it matter?

Inflation is the rate at which prices for goods and services rise, leading to a decrease in purchasing power. It matters because it affects how much we can buy with our money.

How can I protect my finances from rising inflation?

You can protect your finances by investing in assets that typically outpace inflation, adjusting your budget to prioritize essential expenses, and building an emergency fund.

What role does government policy play in inflation?

Government policies, particularly those related to monetary policy and interest rates, can influence inflation rates by controlling money supply and economic growth.

How does global economic change impact inflation?

Global economic changes, such as supply chain disruptions or geopolitical events, can affect commodity prices and overall inflation in different countries.